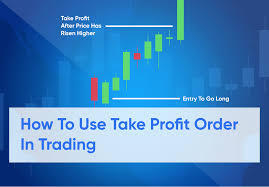

As a trader, maximizing your returns is the supreme objective. To accomplish this, mastering take profit tactics is important. A take profit buy is a form of order that is certainly set to close a buy and sell with a predetermined profit degree. In this article, we are going to discover some take profit methods that will help you in improving your earnings. With one of these techniques, you may attack an equilibrium between keeping your earnings and minimizing your risks.

Setting Targets utilizing Specialized Evaluation

Practical evaluation involves the usage of graphs and indications to ascertain best entrance and exit factors for deals. Upon having entered a buy and sell, specialized assessment can also assist you in placing your profit concentrates on. It is possible to figure out profit ranges based upon specialized indications for example resistance degrees or transferring averages. With one of these signs, you may established a take profit get which is sensible and attainable.

Employing Trailing Cease Loss Orders placed

A trailing end reduction order is an advanced buy type that may be used on a wide open industry. It is an automatic purchase that adapts the quit decrease level as being the industry techniques within your prefer. Trailing ceases enable you to shield your revenue while still permitting your business to go on in case the market place continues to relocate your favour. Because of this in the event the marketplace reverses and starts off relocating against you, the trailing end will close your trade, and you will definitely still understand a profit.

Scaling from Investments

Scaling away from deals involves shutting down simply a section of your industry, although making the remaining portion ready to accept capture much more income. This procedure may be used to take partial revenue when still having some contact with the marketplace. It allows you to lock in some revenue while allowing the remaining investments to work with their total potential. Scaling out could also lessen the effect of possible deficits when the industry moves against you.

Implementing Volatility-Based Strategies

Market place volatility enables you to establish profit focuses on. By way of example, if your market place is regarded as highly unstable, you may established your profit concentrates on in a higher level. Consequently in case the marketplace movements with your favor, you remain to create a larger sized profit. However, in a reduced unpredictability market, you may have to set your profit goals with a reduce stage.

By using a Trading Plan

Having a trading program is a vital aspect in learning take profit techniques. A well-planned trading strategy allows you to keep focused entirely on your main goal and perform your investments with assurance. Your trading prepare must be versatile enough to let you adjust your profit targets based on market problems. A trading strategy can also help with minimizing emotionally charged trading and stop you from generating impulsive selections.

Simply speaking:

In In short, understanding take profit trader techniques is vital for forex traders who wish to maximize their profits. Setting goals using practical analysis, using trailing end decrease requests, scaling out from deals, using unpredictability-structured methods, and having a trading prepare are verified strategies that can help in achieving success. By utilizing these methods, you may stability profit probable with danger management and boost your total trading performance.